How to Read Your Social Security Disability Statement

The Social Security Administration (SSA) mails Social Security Statements to U.S. citizens who are 60 years old or older who aren’t receiving Social Security benefits.

Your Statement will tell you:

- How much money you could collect for disability benefits and retirement every month

- How much your family could collect in survivor benefits

- Which factors could reduce your actual benefit amounts

- Your complete earnings history

- Facts about Social Security retirement and how to prepare for retirement

You could also use the SSA’s online benefits calculator to estimate your monthly benefits. However, this may not be as accurate as the amount on your statement.

If you are younger than 60 years old, you can create a my Social Security account and request a statement to be mailed to you. Your statement will be personalized based on your age.

Keep reading for a page-by-page summary of your Social Security Statement.

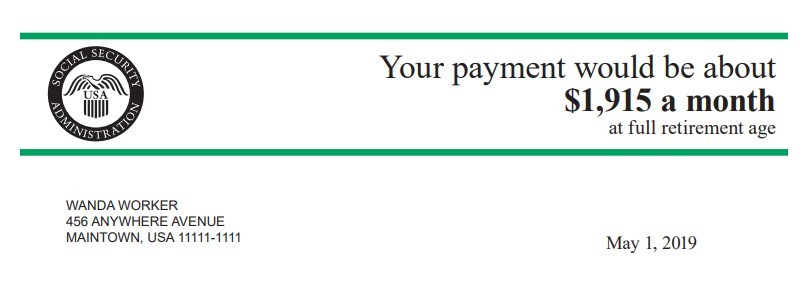

Page 1: Your Social Security Statement

At the very top of Page 1, you will see the estimated amount of money you would receive in Social Security retirement benefits every month if you were approved at full retirement age.

This amount is only Social Security retirement. Your early retirement and disability payment estimates are listed on Page 2.

Remember: because these benefits are based on your lifetime earnings, your payment estimates will be smaller if you are younger or if you have fewer years of work history.

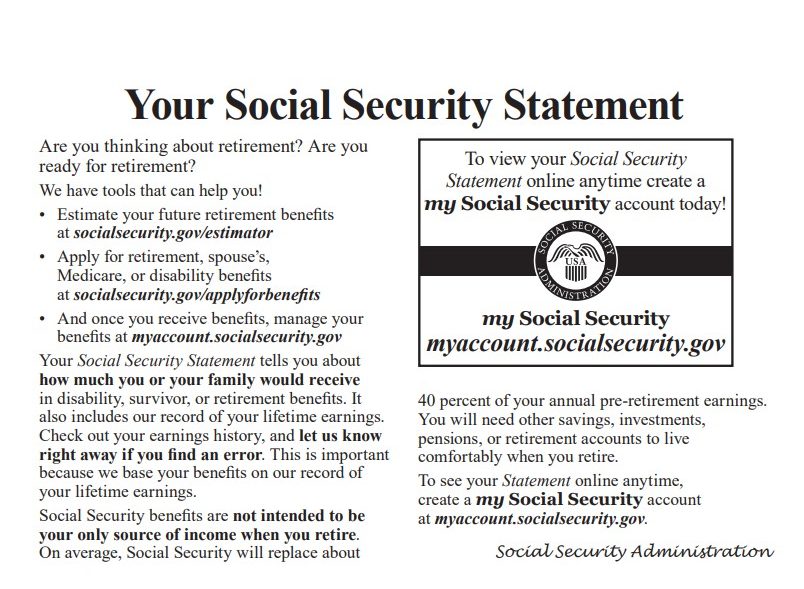

Page 1, continued: Your Social Security Statement (cont.)

The bottom half of Page 1 explains the purpose of your Social Security Statement: to tell you how much you or your family could receive in disability, survivor, or retirement benefits.

The Statement also covers your earnings history. They use your earnings history to calculate your benefit amount, so it is important that these numbers are accurate. You should tell the SSA if there is an error in your earnings history.

Social Security benefits are not meant to be your only source of income after you retire. In fact, retirement benefits will only replace about 40 percent of your pre-retirement earnings. You will need other sources of income—savings accounts, investments, pensions, etcetera—to live off of after you retire.

This is the second purpose of the Statement. You can and should use your estimated benefit amount to calculate how much money you need to save in so you can live comfortably after retirement.

Page 1 also tells you where to calculate retirement benefits, apply for benefits, and manage your benefits online.

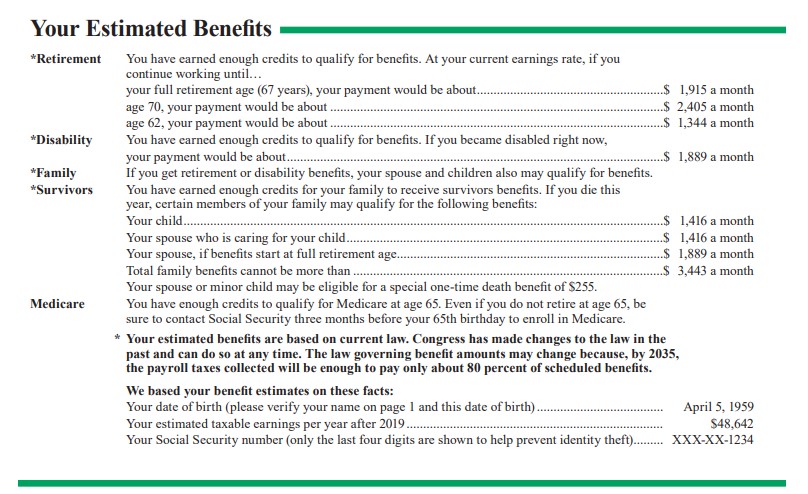

Page 2: Your Estimated Benefits

Page 2 lists your estimated benefits for retirement, disability, and Medicare. This is one of the most valuable pages if you are trying to decide how much you need to save to retire comfortably. For a full description of each type of benefit, see Page 4.

Your Statement may not have an amount for some of the benefit options. This is because you may not have earned enough work credits to qualify. Work credits are earned by paying Social Security taxes. The amount of money you need to earn one work credit varies year by year. Most people need 40 work credits to qualify for benefits.

Check that your birth date and Social Security number on the bottom of the list is correct. Notify the SSA if they are incorrect.

Your disability estimates are based on current U.S. law, which will probably change before you apply for benefits. The retiring generation is much larger than the working generations and under current law, Social Security would only be able pay full benefits to about 80 percent of beneficiaries by 2035. If the law changes, so will your estimates and final benefits amounts.

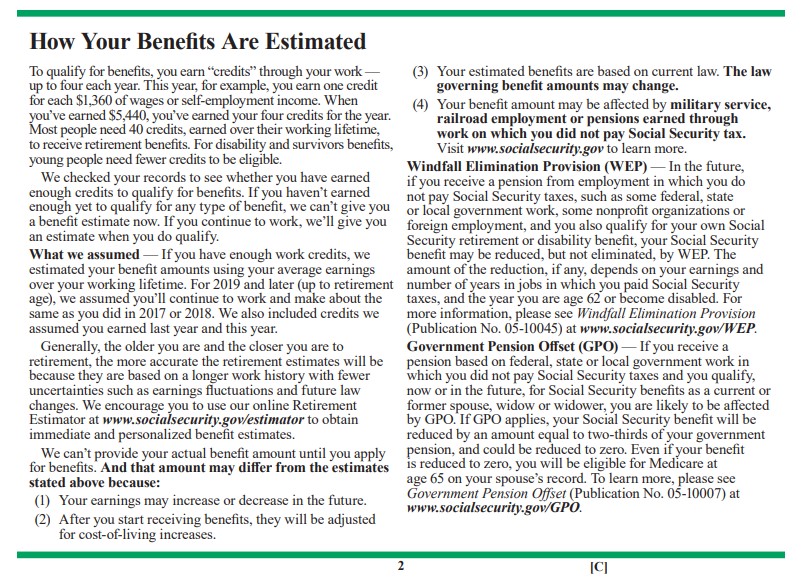

Page 2, continued: How Your Benefits are Estimated

The second half of Page 2 explains how the SSA estimates your benefits. If you have earned enough work credits by the time you receive your Statement, the SSA assumes you will earn the same amount of money every year until retirement. They use this yearly salary to estimate your monthly benefits.

Several factors effect the accuracy of your benefits estimates. The most influential factor is your age. The closer you are to retirement age, the more accurate the estimates will be. If you have many years until retirement or if your work history isn’t as strong, your estimates are more likely inaccurate.

Four more factors that affect the accuracy of your benefits estimates are:

- Your yearly earnings may increase or decrease between now and when you retire.

- After you start receiving benefits, your monthly amount will adjust to meet cost-of-living increases.

- The laws regarding Social Security benefits may change by the time you apply.

- Your benefit amount might be affected by military service, railroad employment, or pensions that are exempt from Social Security taxes.

If you are a railroad worker or have served in the military, you may be exempt from receiving Social Security disability because of benefits programs that already exist through the railroad and the military.

If you receive a government pension or a pension of any kind that is exempt from Social Security taxes, that may also affect the final benefits amount.

Windfall Elimination Provision (WEP)

If you receive a pension from job that does not withhold Social Security taxes from your salary, the windfall elimination provision (WEP) helps ensure that you do not earn a larger percentage than someone who has paid into Social Security with their pension. The minor reduction is meant to help level the playing field between low-wage workers who paid Social Security taxes on every single paycheck, and high-wage workers who paid fewer or no Social Security taxes.

Depending on your onset date or how long you paid into Social Security, the WEP might not affect your benefits at all. More information about WEP can be found here. If you have questions about whether or not your benefits will be affected, a Social Security disability attorney can help.

Government Pension Offset (GPO)

The government pension offset (GPO) only affects Social Security widows/widowers and spouses benefits. If you receive a government pension from which you don’t pay Social Security taxes, your monthly benefits will be reduced by two-thirds the amount of your pension. The GPO helps ensure that spouses and widows/widowers do not “double dip” by receiving a full pension and full Social Security.

More information about the GPO can be found here. If you have any questions about whether your spouse or widow/er benefits will be reduced by the GPO, a Social Security disability attorney may be able to help.

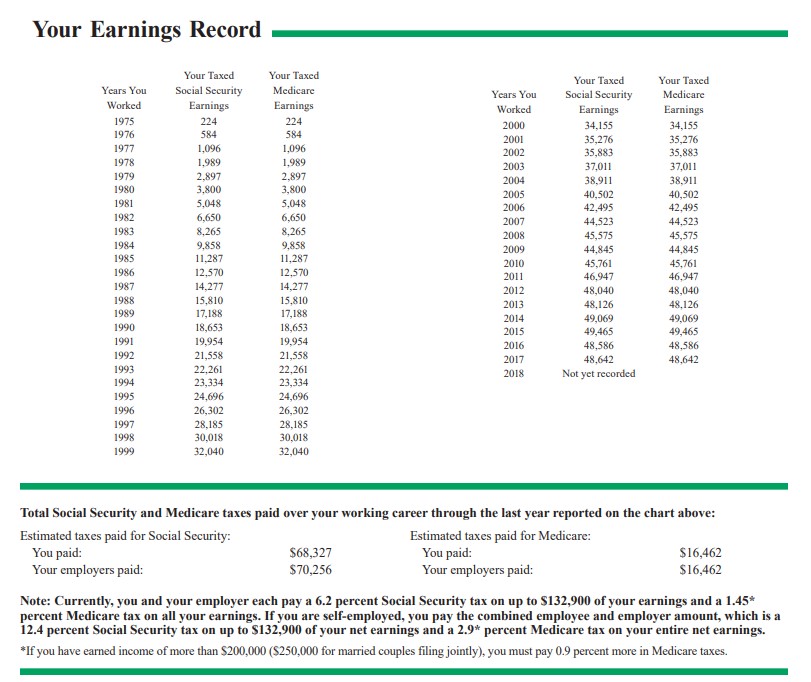

Page 3: Your Earnings Record

On Page 3 you will find your earnings record. This lists how much taxable income you’ve earned every year since you’ve begun working.

You may not see earnings amounts from last year. That is because the SSA may still be processing the previous year’s earnings report.

Below your earnings record is the total amount of Social Security and Medicare taxes that you and your employers have paid over your entire work history.

It is extremely important that you make sure your earnings record is accurate. This is the same earnings record that the SSA will use to calculate your real benefits amount once you retire or apply for disability. If your earnings record is incorrect, that means you could miss out on hundreds of dollars per month.

If you see a mistake in your earning history, you should notify the SSA by calling the number on your Statement and presenting a W-2 or tax stub with the correct earnings for the year in question. It could take a few months for the correction to appear.

Page 4: Facts about Social Security

Page 4 has in-depth information about Social Security retirement, disability, family and survivors benefits, and Medicare.

If you have any questions about these programs, you can visit www.socialsecurity.gov, contact any Social Security office, call 1-800-772-1213 or write to Social Security Administration, Office of Earnings Operations, P.O. Box 33026, Baltimore, MD.

In the second column is a list of SSA publications about retirement. You can find these publications or request a copy from your Social Security office.

Pages 5-6: Facts About Retirement

Remember, Social Security retirement benefits only make up about 40 percent of your pre-retirement salary. The last two pages of your Statement explain more about how to apply for retirement benefits and how retiring early or working after retirement may affect your benefits.

If you would like more information about planning for retirement, please visit the Social Security Administration’s retirement webpage. There you can learn about applying for retirement, read free publications about retirement programs, and plan for retirement using the SSA’s retirement planning tool.

Learn More about Social Security Disability Benefits

Want to know more about disability and retirement benefits? Visit our Frequently Asked Questions page, or download our ebook, Eight Mistakes to Avoid When Filing for Social Security Disability for free.

If you are disabled and thinking of applying for disability benefits, or if you are a few years from retirement age but find yourself unable to work, a Social Security disability attorney can help you determine the best benefits program for you. You can call, text, or chat with us online for a free conversation about your claim.