Do I Need Rideshare Insurance?

If you frequently use Uber, Lyft, or any of the rideshare services out there, you may wonder how the company might handle a personal injury claim if you are injured in a car accident while riding along.

While rideshares generally have their own insurance options to cover drivers and passengers, those plans may not necessarily cover every cost you may face following an accident. This is especially true if you are a driver for the company.

If you’re a rideshare passenger, then you don’t need rideshare insurance to cover you in case of a car accident. However, if you drive for Uber or another rideshare service, you should consider getting a rideshare insurance policy.

Does Uber/Lyft Have Coverage for Drivers?

Uber and Lyft have insurance that generally covers their drivers after a car accident while on the clock. Their insurance includes liability coverage, uninsured/underinsured motorist coverage, collision and comprehensive coverage.

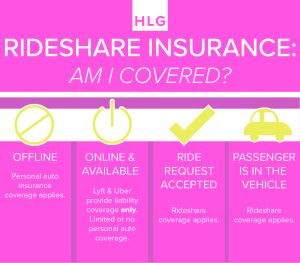

However, this coverage is only in effect during two specific windows of time: when they’re on the way to picking up a passenger, and when that passenger is in the car prior to reaching their destination. If an accident happens when the driver is waiting to accept a ride, none of the coverage applies.

Uber and Lyft also do not provide medical payments coverage. That means that if you are at fault for the accident, they won’t help pay your medical bills.

Rideshare insurance helps fill the gaps in Uber/Lyft insurance by covering you the entire time you’re driving for a rideshare service.

Typical personal car insurance policies (like the ones Geico, Allstate, State Farm, Progressive and others offer) include rideshare coverage as an add-on.

Some insurance providers will drop your car insurance coverage if you start driving for Uber or Lyft because of the added risk. You should notify your auto insurance provider immediately if you decide to drive for a rideshare service. That way they can tell you if you need to purchase rideshare insurance.

In some cases your insurance provider may not offer rideshare insurance and they may require you to get a commercial insurance policy instead.

What Happens if You are At Fault for a Rideshare Accident?

As a driver, you ought to consider the safety of other drivers around you, as well as whoever may be riding along with you. When you’re behind the wheel, you assume responsibility for your passengers’ well-being. But do Uber and Lyft have enough coverage to protect your passengers and yourself after a car accident?

Online and Waiting for Ride Request

If you cause an accident while you are waiting for a ride request, you generally have to file through your own insurance to cover any damages caused to your property, including any injuries.

If your personal policy does not already include rideshare coverage, your claim will probably be denied. Once it is denied then you could use Uber/Lyft’s limited liability coverage.

Uber and Lyft offer $25,000 for property damage and $50,000 bodily injury per person up to $100,000 per accident. This pays for injuries and property damage for the passenger(s) in your car, and the other driver or drivers, if the accident occurs while you are waiting for a ride request.

You’ll have to rely on your own health insurance to cover any medical treatment after an accident you caused.

The span of time between going online and accepting a ride is when your insurance coverage is weakest. You should discuss any gaps in your policy with your insurance provider, and if adding a rideshare policy is a wise choice.

Picking Up a Passenger or Driving a Passenger

If you are at fault for an accident while driving to pick up a passenger or during trips, Uber and Lyft have up to $1 million dollars in third-party liability. This money pays for bodily injury and property damage for the other driver and the passengers in your car.

If you were injured in the accident, it won’t be so easy to get compensation. Neither rideshare company covers their driver’s injuries if the driver was at fault.

If you caused a car accident off the clock, you could use medical payments coverage through your car insurance policy to pay for medical treatment. Uber and Lyft do not offer medical payments coverage. So you’ll have to pay for medical bills with your personal medical payments coverage (if you have it) or your own health insurance if you are injured and at fault.

Uber and Lyft also offer collision and comprehensive coverage for damage to your vehicle up to the cash value of your car. This coverage applies whether you are at fault or not. But the deductibles are high: you would have to pay $1,000 out of pocket for any Uber accident and $2,500 for any Lyft accident.

This coverage only applies if you already have collision and comprehensive coverage through your own insurance. Because of the high deductibles, it might not make sense to use this coverage.

Also, this extra coverage might not help if you still owe money on your lease. Uber and Lyft do not offer gap insurance to their drivers. Gap insurance pays the difference between what you owe and what your car is actually worth, so that you don’t have to keep paying for your car even after it is totaled. Without gap insurance, you might end up owing a lot of money for an undriveable car.

What if I’m Not At Fault for the Uber/Lyft Accident?

You can recover damages after a car accident that wasn’t your fault by filing a claim with the at-fault driver’s insurance. But what if the at-fault driver doesn’t have enough liability coverage to pay for your medical bills? What if they don’t have insurance at all?

Uber and Lyft offer uninsured/underinsured motorist coverage if another driver causes you to crash. This covers you if you are a victim of a hit-and-run or if the at-fault driver doesn’t have enough insurance to cover your damages.

Every Indiana auto insurance policy is required to have uninsured/underinsured motorist coverage unless waived in writing. Every policy is different, but at minimum it covers up to $25,000 for property damage and $50,000 for bodily injury if you are hit by an uninsured/underinsured driver.

In comparison, Uber offers its drivers $1 million in uninsured/underinsured motorist coverage. Lyft’s coverage in this case varies by state. Again, this coverage only applies after you have accepted a ride request or when the passenger is in your car.

You can also use Uber/Lyft’s collision and comprehensive coverage if you are not at fault. But like we said before, you might be better off using your own insurance policy if you have a lower deductible.

So do I actually need rideshare insurance?

Uber and Lyft do offer coverage for their drivers, but it definitely isn’t comprehensive. It isn’t even active the entire time a driver is on the clock.

Before you consider driving for a rideshare service, check with your insurance provider about their rideshare insurance. Ask about any gaps in your policy that may leave you without coverage while driving for Uber or Lyft. Otherwise you could be left paying out of pocket for repairs or bills that aren’t your fault.

If you or someone you know has been injured in a rideshare accident, Hensley Legal Group may be able to help. Call us today or contact us online for a free conversation about your claim.