Car Insurance 101: What’s in Your Car Insurance Policy?

In Indiana, you must have a certain amount of car insurance before you hit the road. But auto insurance policies are famous for being difficult to understand. Combine that with the hope that you’ll never have to use it, and it’s no wonder that 96 percent of Americans can’t correctly define basic insurance terms. Let’s […]

August 13, 2018

In Indiana, you must have a certain amount of car insurance before you hit the road. But auto insurance policies are famous for being difficult to understand. Combine that with the hope that you’ll never have to use it, and it’s no wonder that 96 percent of Americans can’t correctly define basic insurance terms.

Let’s look at a basic insurance policy, line by line, and explain just what you signed up for when you got your car insurance.

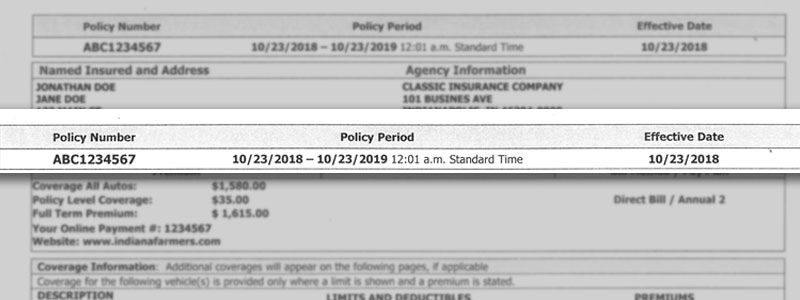

Policy Number and Policy Period

At the top of your car insurance policy, you should see your policy number and policy period. Typically, your policy period lasts for a full year. The effective date is listed as well.

Your policy number is helpful to have handy if you ever get into a car accident. If you don’t have it, someone from the insurance company can likely look it up for you.

What’s more important for you to know is your policy period, including the date it goes into effect. Your insurance policy may not automatically renew at the end of the policy period. Speak with your insurance company to determine how policy renewal works so you’re never without coverage.

Keep an eye on your effective date as well. Most car insurance policies go into effect immediately. However, if you’re changing coverage on a current policy, there may be a waiting period. This is to prevent false claims. For example, if you increase your coverage and file a claim the next day, the insurance company will likely suspect fraud.

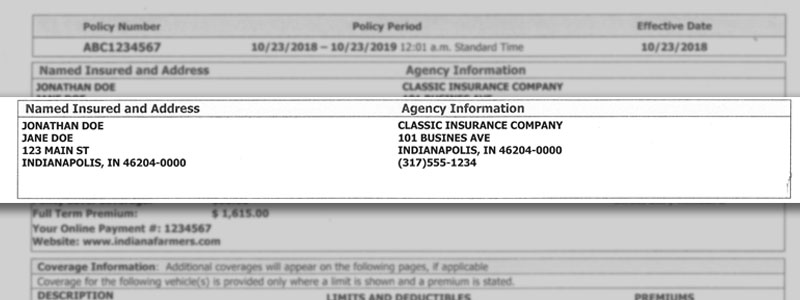

Name Insured, Address, and Agency Information

Here, your insurance company will list your name and address as well as their own. If you and your spouse are both covered under the policy, your names may both be listed, although your spouse is may be covered even if their name is not listed. A phone number should accompany your insurance carrier’s address in case you need to reach them.

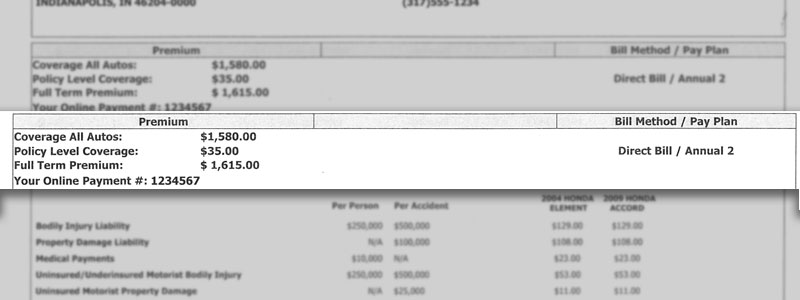

Premium, Bill Method, and Pay Plan

The next section outlines how much you’ll pay each month for your insurance coverage. This is known as a premium.

Your insurance company will also outline here just how they expect you to pay your premium each month. Depending on your insurance carrier, you may have the option to pay online or have the premium taken from your bank account automatically each month. Make sure to speak with your insurance company over how and when to pay your premium.

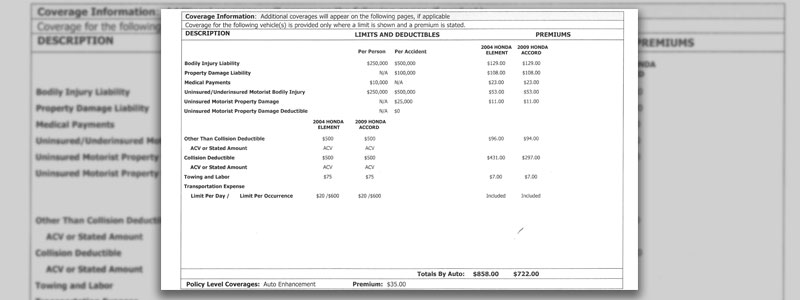

Coverage Information

Finally, we get to the actual insurance policy. Here, you’ll see your insurance broken down by certain categories:

Liability Insurance

- Bodily Injury Liability: This pays for the injuries you may cause to others in a car accident. In Indiana, you must have at least $25,000 per person and at least $50,000 per accident.

- Property Damage Liability: This pays for the damage you may cause to others’ vehicles or property in a car accident. In Indiana, you must have at least $25,000 per accident as of July 1, 2018. Previously, you only had to have $10,000.

Underinsured/Underinsured Liability Insurance

In the event that you are hit by an uninsured or underinsured driver, you can use this policy to recover some compensation from your own insurance company. Indiana does not require you to have this coverage, but it does require all Indiana auto insurance policies to include it unless you reject it in writing.

- Uninsured Motorist – Bodily Injury: $25,000 minimum per person, $50,000 minimum per car accident

- Underinsured Motorist – Bodily Injury: $50,000 minimum

- Uninsured/Underinsured Motorist – Property Damage: $25,000 minimum as of July 1, 2018 (previously, only $10,000)

Optional Insurance

There are a variety of coverage types you may choose to add to your policy:

- Medical Payments: Medical payments coverage (known as Med Pay) covers medical or funeral costs related to the accident up to the limit of coverage you choose. You can access Med Pay regardless of whether or not you’re at fault for the accident.

- Collision Coverage: Collision coverage protects your vehicle in case it gets into a collision with another car or stationary object.

- Comprehensive Coverage: If your vehicle sustains damage in something other than a car accident, comprehensive coverage comes into play. This can include fire, theft, vandalism, hail damage, etc.

- Gap Insurance: Gap insurance covers the money you may still owe on your vehicle. Since your property damage insurance only covers the fair market value of your vehicle at the time of the accident, gap insurance can cover the cost of any outstanding loans you may still have on the vehicle. Gap insurance isn’t offered by every insurance company, however.

- Rental Coverage: Rental coverage can help pay for a rental vehicle if you need to repair or replace your car after an accident, up to the limit of coverage you choose.

Deductibles and Premiums

This section also goes into detail about your deductibles and premiums.

Your deductible is the money you must pay first before your insurance company will start paying after an accident. It’s the out-of-pocket payment you must make before your insurance kicks in.

Your premium, on the other hand, is the amount of money you pay each month for insurance, regardless of whether or not you’ve been in an accident.

Typically, if you have a higher deductible, your premium may be lower, and vice versa. Your insurance policy should list both in this section and break them out per vehicle and per type of coverage.

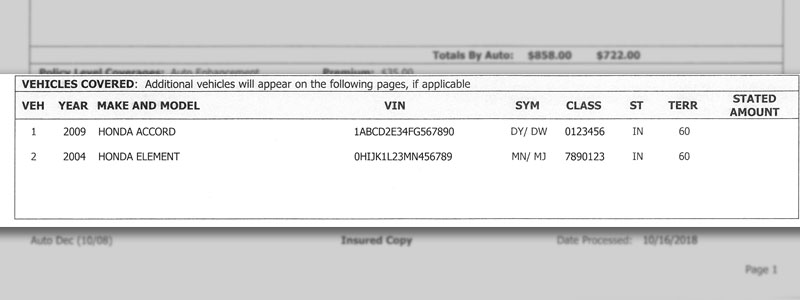

Vehicles Covered

Here, your insurance company will go into detail about the vehicles covered under this policy. It’ll include basic information such as the year, make and model, and VIN (vehicle identification number) of each vehicle.

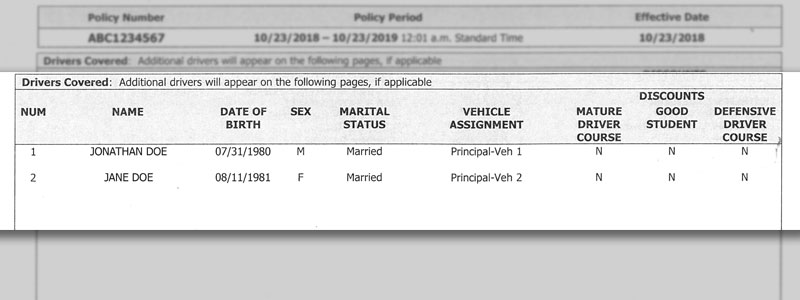

Drivers Covered

Next on your car insurance policy will be a list of all drivers covered under the policy. In addition to including basic information about the driver and their vehicle, it may also include special discounts available for each driver. Some insurance companies, for example, offer discounts to students with all As or drivers who take defensive driving classes.

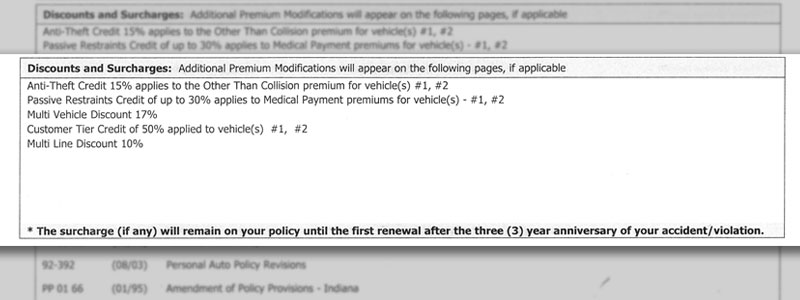

Discounts and Surcharges

Certain discounts per person may be listed in the “Drivers Covered” section, but most other discounts are listed here. You may be eligible a variety of discounts for things like:

- Insuring multiple vehicles

- Having a vehicle with low mileage

- Having a new vehicle

- Being accident-free

- Transferring from an insurance competitor

Discounts vary depending on who your insurance carrier is. Be sure to ask your insurance company what sorts of discounts they offer and which ones you may qualify for.

Surcharges are also listed here. Surcharges may be put in place as punishment for a car accident, for example, or for getting a speeding ticket. They increase your monthly premium.

The good news is that surcharges expire. Typically, surcharges expire after three years, although some states allow them to continue for as long as seven years.

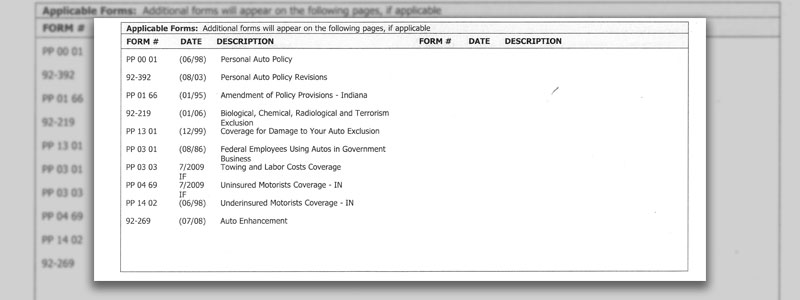

Applicable Forms

The section regarding applicable forms lists any forms that may appear on the rest of your policy. These outline certain facets of your policy.

Everyone’s applicable forms are different because not everyone has the same auto insurance policy. It’s important to go through each form carefully and make sure you agree to what you’re signing up for.

Understand Your Car Insurance after an Accident with an Indiana Car Accident Attorney

Simply trying to understand your car insurance policy can be overwhelming. Throw in the pain of injuries, the headache of property damage, and the frustrating phone calls with the insurance company, and you’ll begin to understand why so many people choose to let an Indiana car accident attorney take care of their claim for them.

Hensley Legal Group is here to help after an Indiana car accident. Our experienced car accident lawyers can fight for the compensation you deserve. The best part? We don’t get paid unless or until you do. Call us today or contact us online for a free, no-obligation consultation about your claim.

Available 24/7

Free Case Review

You won’t pay any fees until we win your case.

It’s easy - you can: